Are you looking for a review of Pacific Precious Metals? Look no further.

Here, you'll find an in-depth review of this company and its services so that you can make an informed decision about whether or not it's the right choice for your needs.

We've done all the research for you to provide a comprehensive overview on Pacific Precious Metals' operations and offerings. Read on to learn more about what they have to offer as well as any potential drawbacks.

Pacific Precious Metals is a prominent provider of gold and silver bullion products, with locations across the US and Canada. They specialize in providing high quality precious metals at competitive prices, along with offering other related products such as coins, numismatic items, jewelry, watches, and collectibles.

What sets Pacific Precious Metals apart from many challengers is their commitment to customer service excellence; they strive to go above and beyond expectations when it comes to responding quickly to inquiries and requests while also providing educational resources regarding investments in physical assets like coins and bullion bars.

Their website features detailed product description pages which help customers understand the differences between various options available before making a purchase - something that few competitors offer!

Disclosure: Some of the links in this article are from sponsors. The list below is an honest review gathered from thorough research, experience, and consumer-based feedback.

Before we get started with this review:

We understand that choosing a company to invest with is an extremely important financial choice; good news for you, we have done all the research and digging in this field for years.

That being said, through our rigorous review process, we have compiled a list of our 5 top gold investment companies for 2022.

>>>Click HERE to Read Our List of the Best Gold IRA Companies in 2023.<<<

Check if Pacific Precious Metals made our top 5 list in 2023!

Or...

Get a FREE Gold Investing Kit from our #1 recommendation by clicking below:

Pacific Precious Metals Background

Pacific Precious Metals is a gold, silver and other precious metals investment company that has earned a reputation as one of the leading providers of financial services through virtual consultations on the volatile precious metals market.

Pacific Precious Metals offers its customers access to resources such as Goldco Precious Metals and Euro

Pacific Precious Metals for an array of products ranging from coins to bars. With over 15 years' experience in the industry, this company provides expertise and guidance that many investors feel comfortable relying on when making decisions about their investments.

Pacific Precious Metals employs a team of knowledgeable professionals who are passionate about helping consumers make sound choices based upon their individual needs and objectives while also providing education on factors that can help determine success.

The company's website includes helpful information regarding current trends, news releases, articles written by experts, along with calculators to assist clients in making informed decisions about investing in precious metals. Through all these tools, they offer comprehensive service packages tailored to meet each customer’s unique financial goals and risk tolerance levels.

They strive to provide a safe and secure environment where customers can confidently buy or sell physical gold, silver, platinum, palladium coins and bullion at competitive prices without worrying about potential fraud or theft.

The mission of Pacific Precious Metals is clear: to provide superior value-added solutions which empower our customers with knowledge and confidence so they may reach their desired level of wealth security.

As part of this commitment to excellence, their advisors take the time necessary to understand each investor’s specific circumstances before recommending any course of action – something not every competitor does!

By taking into account both short-term goals and long-term objectives alongside risk management strategies designed for maximum protection against market volatility, Pacific Precious Metals strives for total client satisfaction every step of the way.

Services Offered by Pacific Precious Metals

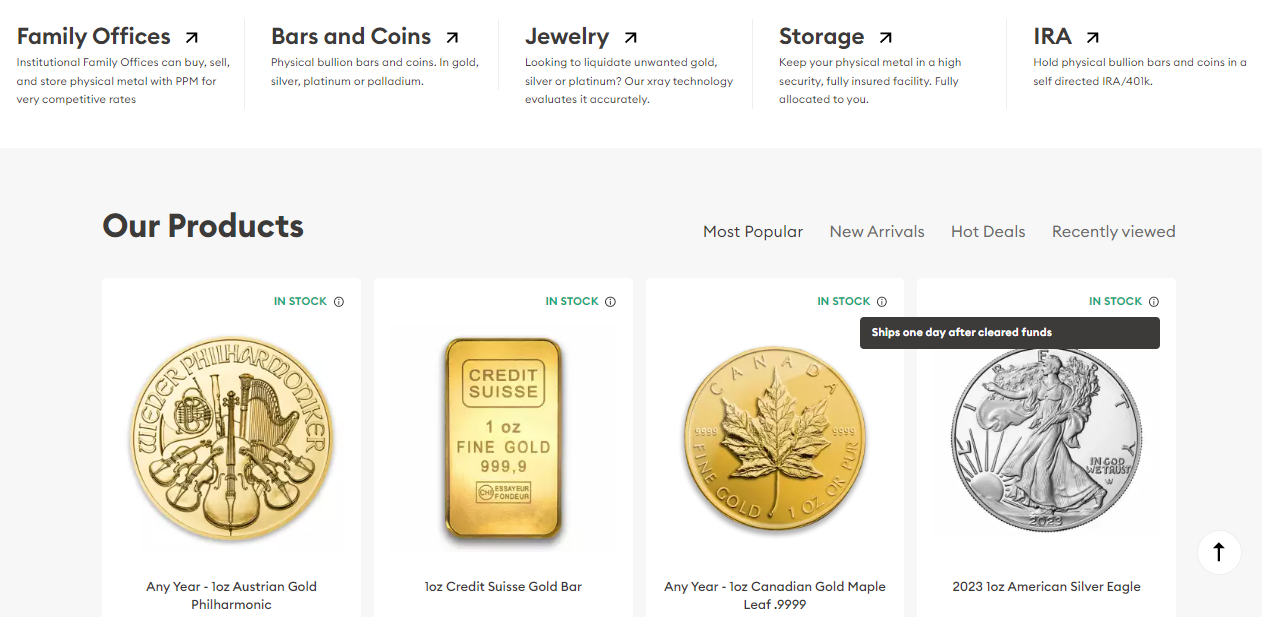

Pacific Precious Metals offers a variety of services for those who want to invest in precious metals. They provide both physical metal investments, including coins and bars, as well as digital investments through Precious Metal IRAs (Individual Retirement Accounts).

Through their online platform, customers can purchase bullion products such as gold, silver, platinum, palladium and other select rare coins.

Pacific Precious Metals also provides professional storage solutions for customers’ precious metals holdings, including secure vaulting locations across the United States.

The customer service team at Pacific Precious Metals is dedicated to helping clients maximize their investment potential.

The company has staff members available 24 hours a day to answer any questions about the process or product offerings that may arise. From initial setup guidance to ongoing account management advice, they are committed to providing exceptional support for investors throughout their journey with Pacific Precious Metals.

All transactions are backed by an industry-leading satisfaction guarantee so customers always have peace of mind when making purchases from this trusted provider.

With competitive pricing on quality products and reliable customer service options designed to ensure long-term success, Pacific Precious Metals stands out among its peers in the precious metals space.

As investors look to diversify their portfolios with alternative assets such as gold and silver bullion products or digital alternatives like IRAs, it pays off to consider these experienced professionals that offer top-notch value and expertise.

With years of experience in the industry and a commitment to excellence in every area of operations, Pacific Precious Metals makes it easy for anyone looking for ways to invest in precious metals confidently and securely. Now that you know more about what the company offers let's move onto how they store your bullion safely....

Storage 0f Bullion

For investors who have made the commitment to purchase bullion, secure storage is of paramount importance. It's a bit like locking your valuables away in Fort Knox- you want to be sure that they're safe and sound!

Fortunately, there are several options available when it comes to storing precious metal investments:

- Bullion dealers often provide storage services for their customers, usually at an additional cost. This option may be attractive if the investor prefers not to store their own gold bars or silver bullion.

- Precious metals exchanges also offer a variety of storage options which can be tailored to meet individual needs. They generally include climate-controlled vaults with 24/7 security monitoring so that investors' holdings remain protected from theft or damage.

- Self-storage is another popular choice among those who prefer to keep their investments close at hand. Investing in a fireproof safe is an important step for anyone considering this route as it provides extra protection against potential disasters such as floods or fires.

Of course, each option has its advantages and disadvantages depending on the individual's investing goals and preferences - but no matter what method the investor chooses, ensuring the safety of their investment should always be top priority!

With careful consideration and research into all available storage options, investors can rest assured that their precious metals will remain secure while under their care.

What Is a Precious Metals IRA?

As you now know, storing precious metals is important if you want to ensure that the value of your asset remains intact.

But what exactly is a Precious Metals IRA?

An individual retirement account (IRA) specifically designed for investing in gold and silver coins or bars is known as a Precious Metals IRA. This type of IRA allows investors to set up an account with tax-deferred savings on their investments.

When it comes to deciding which Precious Metals IRA provider will be best suited to meet your needs, there are several factors that need to be taken into consideration.

For instance, Augusta Precious Metals provides Gold IRAs with competitive pricing and no hidden fees, while Pacific Precious Metals offers Silver IRAs backed by secure storage options and accessible customer service.

Both companies provide tools such as online calculators and market alerts so customers can make informed decisions about their investments.

Ultimately, both providers offer excellent services when it comes to setting up a Precious Metal IRA - it's just a matter of finding the one that works best for you.

Should You Choose a Traditional or Roth Precious Metals IRA?

When it comes to investing in precious metals, one of the most popular options is a Traditional or Roth Precious Metals IRA.

These are special types of retirement accounts that allow you to invest in physical gold and silver coins and bars at competitive prices from reputable dealers like Pacific Precious Metals.

The primary difference between these two account types is how they're taxed when you withdraw funds from them during retirement.

A Traditional IRA allows you to deduct your contributions from your taxable income for the year. However, this money will be subject to taxes when you make withdrawals during retirement age.

On the other hand, a Roth IRA works differently because you pay taxes on your contributions upfront but all future gains are tax-free once you reach retirement age.

So if your goal is to save as much money as possible in the long run then choosing a Roth IRA might be the better choice since there won't be any additional taxes down the line.

You should also consider which type of metal investments best suit your needs before committing to either option.

Gold bars are an excellent way to diversify an investment portfolio while silver coins can offer more liquidity than larger gold bar denominations due their smaller sizes and lower market values.

It's important to do some research on the different types of products available and compare prices with various dealers such as Pacific Precious Metals before deciding which route is right for you.

What Is a Self-Directed IRA?

A self-directed IRA is an individual retirement account (IRA) that allows you to make investments in asset classes that are not typically offered by traditional financial institutions.

These accounts can be set up with a variety of custodians, including banks and brokerages, but the investor has full control over their funds and investment decisions.

With a self-directed IRA, investors can choose from a broader range of alternative assets such as real estate, precious metals like gold coins or jewelry, private business interests, venture capital opportunities, tax liens, hedge funds and cryptocurrency.

- As long as the investments fit within existing IRS regulations, they are allowed under this type of account setup. However it’s important to note that these types of investments carry significantly more risk than those offered through standard financial institutions so proper due diligence must be conducted before investing.

Here's what you need to know about investing in precious metals:

- Investing in physical gold requires knowledge on how to buy at spot price and store it safely at a physical location.

- Gold coins come in various denominations so you can start small if desired.

- Buying gold jewelry may offer some protection against inflation since its value usually increases with the price of gold while offering aesthetic appeal too.

- Dental gold is also available for purchase as scrap metal which adds another option into your portfolio mix.

Despite all the options available when using a self-directed IRA, it's important to remember that these investments should only constitute a portion of one’s overall portfolio strategy and should always be done with caution and sound judgment; seeking professional advice is never a bad idea either!

How to Open a Precious Metals IRA

Opening a Precious Metals IRA can be an exciting opportunity for those looking to diversify their retirement portfolio.

A Precious Metals IRA is similar to a traditional individual retirement account (IRA), except that it includes investments in physical bullion and coins of precious metals such as gold, silver, platinum, and palladium instead of stocks or bonds.

This type of investment offers numerous advantages over other forms of investing, but there are several important considerations to keep in mind before opening this type of account.

The first step when considering opening a Precious Metals IRA is to find the right custodian. This may include researching different companies within the precious metals industry, comparing fees and services offered by each company, reading customer reviews and recommendations from previous customers, and seeking advice from financial advisors familiar with the bullion markets.

Investors should ensure they choose a custodian based in the United States that has been approved by the Internal Revenue Service (IRS).

It is also helpful to make sure any gold companies selected have experience trading with countries like South Korea who actively participate in Pacific Precious Metals Exchange (PPX) activities.

Once you've chosen your custodian, you will need to decide which types of physical assets you want included in your portfolio - such as gold bars or coins - along with how much money you plan on investing into the account each year.

You'll then need to open an account with your chosen custodian and transfer funds from either your bank or another existing retirement account into it.

Once these steps have been completed successfully, you can start buying eligible products through your new Investment Retirement Account using the funds transferred earlier. After making purchases through your Precious Metals IRA, don’t forget to regularly track performance metrics and consider rebalancing at least once per year if needed due to changes in market conditions or personal preferences.

With careful research and diligent monitoring of investments made through this form of retirement savings vehicle, individuals can enjoy many benefits while mitigating potential risks associated with owning precious metals.

As we move into discussing whether a Precious Metal IRA could be beneficial for you personally...

Is a Precious Metals IRA Right for You?

When it comes to investing, there are many options available. One such option is a Precious Metals IRA (Individual Retirement Account).

A Precious Metals IRA allows investors to hold physical gold and silver bullion within a retirement account that has the same tax benefits of other types of IRAs.

As with any investment, before you make the plunge into precious metals investing, you should weigh all your options carefully.

Pacific Precious Metals offers an extensive selection of coins and bars for customers’ individual retirement accounts. They also have competitive rates on their products and customer satisfaction remains at a high standard when compared to competitors in the market rate.

All orders placed from them come with insured shipping so as not to run the risk of damage or loss during transit.

Pacific Precious Metals prides itself on offering knowledgeable customer service representatives who can help guide potential buyers in making informed decisions about what type of metal product best suits each individual's needs.

The next step is to consider the cost associated with shipping these items; depending on where they need delivered, this may be more expensive than merely buying the metal itself!

Cost of Shipping

Once you have decided that investing in precious metals is the right choice for your retirement portfolio, it’s time to think about getting those investments shipped safely and securely to you.

Shipping costs vary depending on which company you purchase from, but there are several options available.

When buying gold or other precious metals from Pacific Precious Metals, shipping fees depend on the size of your order as well as any additional insurance requirements.

All orders over $500 automatically qualify for free express delivery with full insurance coverage included. Orders under $500 will require a flat rate fee plus an optional insurance fee if desired.

Augusta Precious Metals also offers free insured shipping with no minimum purchase required. Depending on where products are being shipped within the United States, this could take anywhere between 3-7 days to arrive at its destination.

If ordering outside of the U.S., customers should expect longer wait times usually ranging between 5-15 business days due to international customs laws and regulations.

In Asia Pacific Gold Markets (APGM), shipping rates can range anywhere from standard ground to two-day air service depending on what product is being purchased and how quickly it needs to be delivered.

APGM also offers third party insurers who provide coverage against potential losses during transit including theft or damage caused by weather conditions such as flooding or hurricanes.

The cost of these services varies based upon each individual shipment's value and weight:

- Standard Ground: Up To $25 Per Package

- Two Day Air Service: Up To $50 Per Package

- Third Party Insurers: Varies Based On Value And Weight Of Shipment

It’s always best to check out a company’s BBB Business Profile before purchasing anything online just to make sure they offer reliable customer service and competitive pricing when it comes to shipping their products safely and securely around the world.

Doing so helps ensure that all items arrive exactly as expected without having any unnecessary delays or complications along the way!

How Are Precious Metal Products Shipped to You?

Pacific Precious Metals is committed to providing customers with the highest quality of business services.

The company takes pride in its attention to customer satisfaction and affordability, delivering a wide range of products through their digital platform.

Customers can purchase precious metals such as gold or silver coins, bars, rounds, and ingots from Pacific Precious Metals at competitive prices while still experiencing personalized service.

Customers who order precious metal products from Pacific Precious Metals will find that they are securely shipped via USPS or UPS.

Orders over $500 receive free standard shipping within the continental United States. All orders also include insurance coverage for full value protection against loss or damage during transit.

Pacific Precious Metals ensures that packages are discreetly labeled so no one else knows what is inside-- ensuring privacy for all customers!

When ordering through Pacific Precious Metals’ online store, you'll have the option to track your package's progress every step of the way until delivery.

If you'd like more detailed information about how your items are packaged before shipping, don't hesitate to reach out to their support team for assistance - Pacific Precious Metal prides itself on attentive customer service!

Conclusion

When it comes to investing in precious metals, Pacific Precious Metals is one of the most reliable and respected providers. It offers a wide range of services that can help investors get started with their investments or add more diversity to an existing portfolio.

The company provides secure storage solutions for bullion, along with IRA plans designed specifically for gold and silver investments.

The process of opening a Precious Metals IRA is not overly complicated, but there are some important steps to follow in order to ensure your investment grows as expected.

Understanding the differences between traditional and Roth IRAs will help you decide which plan best meets your needs.

Once everything has been set up properly, you'll need to consider how much it costs to ship precious metal products from Pacific Precious Metals directly to your door – something else worth researching before investing too heavily into any particular product.

When considering purchasing precious metals through Pacific Precious Metals – or any other provider – be sure to do your research first so that everything goes according to plan. As they say “An ounce of prevention is worth a pound of cure”!

You can get a Complimentary Gold Investing Guide from the top gold investing company we recommend by clicking the button above.

If you'd like a thorough review of the top 5 list, click here:

>>>Click HERE to Read Our List of the Best Gold IRA Companies in 2023.<<<

Or, visit Pacific Precious Metals below: